2021’s Best Credit Card Offers – No Annual Fee & 0% Intro APR

Best Low Interest Cards With 0% Intro APR Until 2022

Various providers offer convenient credit cards that empower you to spend now and pay later. There are multiple types available to match your preferences and credit requirements. These include low-interest credit cards; optimized to offer amazing experiences in travel, hotel, and entertainment as well as shopping. The credit cards with no annual fee compared to 0% interest credit cards are different because they only save money on the fee that you pay every year. You might be loathed to be an annual fee every year, But you must be certain that you have had a look at the cards to see if they can save you more money by using different interest rate programs. The best credit cards with low interest fee charges are perfect for you because they allow you to save money every time you make a payment. You might choose to use these cards because you want your payments to be lower, or you might compare these cards because they have no annual fee.

Why Annual Fees Exist

Credit cards charge an annual fee to keep your account active. They also charge an interest rate on the due balance computed on a monthly basis. This interest rate is variable and is calculated from your credit history. You can make sustainable monthly repayments using low-interest credit cards. This also builds your credit score. They allow you to maintain your lifestyle by reducing the amount of interest you pay on the due balance every month. Low-interest credit cards are an attractive option if you find yourself carrying over last month’s balance. This could be the result of making big purchases or accrued debt on your credit cards. Selecting low-interest credit cards can be a daunting task. Here’s a review of some of the most popular low-interest credit cards available today. Compare the benefits and offers from each to make an informed decision.

The Best Credit Cards With Low Interest Fee

The best credit cards that you can get will help you save money because they always keep your rates as low as possible. You might choose to use the cards to transfer your debt first. You could use them for daily purchases in the future, and you also must look at the ways that these cards pay you back for the things that you have paid for. You must choose these cards because you know that they are designed to help you establish or repair your credit. You could choose these cards because you need help with the different things that must be done so that you can clean up your credit report.

How Do You Apply?

You can apply for these cards at any time, and you will find that you could choose the cards online after doing some research. You might prefer to use the cards that have the lowest rates, and you must use these cards because you want to have something that is approved almost instantly. You could apply through the letter that you get in the mail, and you must look into the different ways that these cards offer you savings. Compared to 0% interest credit cards, these cards will offer you that one bit of savings every year, but that might be all you need. You could apply online because you need a card fast, or you could find something that will be more effective over the long term.

Interest Rates Pile Up

Interest rates pile up over time, and getting these cards into your wallet will help you save money over many months. Your payments stay low, and they help you make the best possible choices for your future finances. You might keep these cards because you can keep transferring balances out of them, and you could use the card to set up your future purchases. You might need to save money to make a big purchase, and you could use these cards for daily purchases. Keeping the card in good standing makes it easier for you to use in the future, and it looks great on your credit report.

Amex EveryDay® Credit Card

American Express offers some of the finest no interest credit cards. You can maximize your rewards with the 0% interest credit cards through redeemable membership points. This one has no annual fees and 0% interest for a year. After that, the rate adjusts to a low of 13.99% based on your credit history. The Amex credit cards enjoy an updated vendor base with more than a million new suppliers accepting it.

Chase Freedom Unlimited

This is one of the best credit cards without annual fees. It has a spending bonus of $150 on the first $500 you put on the card within the first three months. It features an introductory offer of 0% for the first fifteen months. No interest credit cards such as Chase Freedom Unlimited provide relief to those with frenzied finances. It has a high reward rate of up to 1.5% cash back on the expenditures on the card. The cash back rewards remain active as long as the account is in use. The interest rate adjusts to a low of 15.99% after the expiry of the 0% offer during the initial period.

Discover It

This is one of the leading 0% interest credit cards available in the industry. The card has a low initial rate “APR” of 0%. This adjusts to a low rate starting at 11.99% based on your credit score. It has attractive benefits and offers including cash back rewards, free foreign transactions, no annual fees and no charge for late fees for the first time. Additionally, the extended interest-free period of one and a half years gives you convenient space to wiggle out of debt. You can earn up to 5% cash back on quarterly rotating categories by purchasing from select stores. Enjoy some of the perks of no interest credit cards by applying online.

Citi Simplicity® Card

These Citi credit cards feature no annual fees and no late fees. The cards are the perfect fit for those looking for 0% interest credit cards. Citi Simplicity® Card maintains a 0% APR for the first twenty-one months. The service has exceptional customer care. You can set up your schedule for paying bills. Where else can you get no interest credit cards for close to two years with zero penalties? The rate defaults back to a low of 14.99% after the offer period ends.

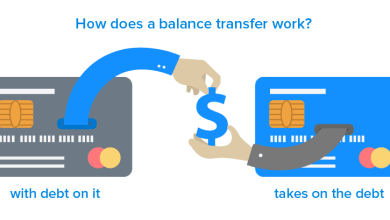

Balance Transfers

You can avoid high-interest rates by transferring your balance to one of the new 0% interest credit cards. This gives you time to clear your debt without undue pressure. There are various credit cards that support your unique lifestyle and spending habits. There are no interest credit cards as well as numerous offers for low-interest credit cards. You can go for 0% interest credit cards to find relief in emergency situations. You can get as many cards as you like, and you will find that you could upgrade from one card to another. You could upgrade because you want to get more spending power, or you could upgrade because you want better rewards. You could choose cards that offer very specific rewards, or you could choose cards that allow you to get approved quickly. You might want to use the cards for daily purchases, and you could keep another one to pay off debt.

How Long Should You Keep These Cards?

You can keep these cards open for as long as you want. You might want to have these cards open in case of an emergency, or you could have used the cards to make big purchases because they have available credit on them. You might select these cards one at a time because you move from one to the other as you build your credit, but you must ask the people at the card company if they have something that will work for you. You might select cards that offer rewards, and you could leave them open for years because you want them to accumulate the rewards that you need.

The Cards Have Concierge Service

You are given concierge service through the company that is on the logo of the card, and you could contact the customer service team if you need help with concert tickets, sporting events, and any other programs that require the card. You could use the card to get into a festival, or you could use the card to make a special purchase. The cards are very flexible, and they do more for you than most other cards.

Conclusion

Someone who plans to use their credit cards to consolidate their debt will find that they could save money, use their cards to get rewards, and plan for the future. They are given a chance to spend less on these cards, and they could use these cards in a number of places that they would not have thought of before. The cards offer total financial freedom.