Successfully Build And Manage Your Credit With An Indigo Platinum MasterCard

Less Than Perfect Credit? Apply Now For Indigo MasterCard.

If you have ever been through a bankruptcy, you know that it is difficult to build your credit score back up to a high level or even obtain a credit card. Bankruptcies can be listed on your credit report for as long as 10 years. This is a long time to wait if you’d like to apply for credit. You are probably like most individuals who prefer having a small cushion of credit available to pay for financial emergencies when they occur. Fortunately, the Indigo Platinum MasterCard was created for individuals like you who have made some financial mistakes in the past. The Indigo credit card has guidelines that may allow you to obtain a line of credit, even after going through a bankruptcy.

Your Credit History Is So Important

Your credit history is a crucial factor when banks or other lenders are considering giving you credit. It’s difficult to obtain a credit card or receive a loan for a small piece of equipment, automobile or other necessity when you have a history of bad credit. When these lenders check any of your credit reports that are provided by TransUnion, Experian or Equifax, your bankruptcy is going to pull up a red flag and probably eliminate you from getting that line of credit or credit card that you need. Your credit score is also going to be at a lower level if you have any type of bad credit.

The Importance Of Your FICO Score

The most commonly used number comes from your FICO score. While the exact formula to calculate your credit score is not shared publicly, there are some broad factors that go into making up your score. These major areas include the following:

- Payment History 35% – This factor includes your ability to pay your loans on time.

- Amounts Owed 30%- Your credit utilization should be kept under 30 percent. Make small purchases.

- Credit History 15% – Keep your accounts open to show a long period of credit history.

- Types Of Credit Used 10%- Utilize different types of loans over a long period of time.

- New Credit 10% – Wait a period of time before opening new lines of credit.

Consider all of these factors whenever you are using or applying for credit. They all make a big difference in factoring your credit score.

Using Your Card

Once you’ve applied and been accepted for the Indigo Platinum MasterCard, you’ll want to manage your credit in a wise manner by following those factors that are listed above. Only make small purchases with your new credit card and keep your balance under the 30% limit of your total credit line. If you have $1000 available, you should only charge up to $300. This will show that you are not desperate to use your line of credit and can easily pay your bill.

Tips For Using Credit Cards to Rebuild Credit

When employing steps to build credit with Indigo platinum master card there are other important considerations to keep in mind aside from understanding your credit history and how to rebuild your credit. Knowing how to maintain your momentum once you have begun to establish a positive credit profile will ensure that your credit score continuously increases instead of wavering up and down. Additionally, you must understand how to most effectively utilize Master cards your Indigo Platinum Master Card in order to better control what information is contained in your credit file so that you avoid negative entries.

Pay On Time

You have already learned that paying your bill on time is a factor that makes up 35% of your credit score. It’s imperative that you pay the minimum amount on your credit card bill every month. It’s even better if you can pay off your total bill each month. This allows you to avoid paying any interest. It’s much better getting in the habit of making small purchases and paying off the total balance each month. You don’t want your outstanding credit to snowball and become a huge burden. Once you’ve obtained your credit card and established your credit-worthiness by utilizing small amounts of credit and paying your bill on time, just repeat the process month after month. Slowly, your credit score will increase and you will build your credit back up to a level that shows you have a high ability to pay back your debts.

Make Multiple Payments

Making multiple payments each month is very effective for paying down the balance of your credit card debt. It also shows that you take your credit seriously and that you are not using it to survive. Even more, making multiple payments will decrease the amount of interest that you pay in the long run and will ensure that more of your payments are applied toward the principal. One of the most interesting facts about the indigo platinum master card is that each payment is applied immediately, so your interest is calculated based on your most current payments, thereby decreasing the total amount of interest paid.

Avoid Late Payment Entries

Making your payments on time not only decreases the amount of interest that accrues on your balance, but it also prevents late entries from accumulating on your credit file. Every time you are 30 days, 60 days, or 90 days late on your bills that are reported to your credit file, those are notated on your account. And as time goes on, those late entries accumulate. So if you are late paying your credit card bill three months out of the year, those three entries will cause your credit score to suffer for years to come. That is why it is important when taking steps to build credit with Indigo platinum master card to not only making payments on time but to monitor the number of Les in trees that are accumulating on your file. At all costs, minimize and the number of 30 days late entries so that there are few or none on your credit report, and by all means, avoid accumulating any 60 or 90-days entries at all.

Pitfalls To Avoid When Using Credit Cards To Rebuild Credit

Being a responsible cardholder is not enough steps to build credit with Indigo platinum master card at all. You must also avoid the most common pitfalls that credit card users often fall victim to in order to avoid unintentional mistakes that may damage your progress. Avoiding these pitfalls, you can ensure that you’re rebuilding strategies will be successful and those unsuspecting circumstances may not detrimentally affect your credit score or overall credit standing.

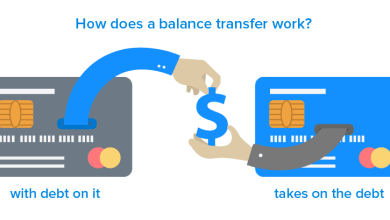

Avoid Balance Transfers

Many people acquire new credit cards in order to transfer the balance from previous cards. While this can be helpful in reducing the balance on a maxed out credit card. It may even seem like a good way to relieve the stress and burden of high-interest rate charges and late payment fees associated with your other credit cards. It does indeed increase your available balance on your new card, but it increases the balance of your Indigo Platinum Master Card. But what most people do not consider is the fact that transferring balances give off the appearance that, since you are constantly carrying a high balance on your cards, you are in need of credit in order to stay afloat financially.

Simply Put

In other words, transferring a balance from one card to another does not eliminate debt. Instead, it makes you appear desperate for available credit. This acts as a signal to lenders, warning them to be cautious about extending additional credit to you because of concerns over whether you will be able to satisfy all of your debts collectively or be forced to consolidate your debt for a reduced payment amount. Lenders will worry that your financial situation may be dire if you habitually transfer balances, so it is best to avoid them altogether.

Read The Terms Carefully

It is important to learn all of the facts about the indigo platinum master card as well as any other fees associated with the use of the card. While many people begin using their card without first educating themselves about the terms that are associated with the extension of credit, doing so while attempting to rebuild your credit can be detrimental to your progress. Just as your credit limit is established based on your individual profile, each credit card has its own terms of compliance facts about the indigo platinum master card that must be adhered to carefully in order to successfully rebuild your credit. Without being fully aware of your interest rate, yearly fees, and all other terms associated with your card, you may find that your credit score will continuously decrease instead of increasing as you originally planned because of unexpected changes to your account.

Open Just a Few Accounts

After opening up your new credit card account, slowly use it for a number of months. After doing so, it’s better to ask for a higher limit of credit than obtaining another new credit card. Often, if you have been diligent about paying on time, the bank that services your card will raise your credit limit. If you do decide to open another account with another type of credit, do this in a slow manner after you have built up your creditworthiness. This shows that you know how to manage your credit and use it in a prudent manner.

Avoid Applying To Gas and Department Store Credit Cards

Once you have activated your Indigo Platinum MasterCard, your credit profile may qualify you for gas credit cards as well as department store credit cards. At all costs, avoid applying for any new cards after initiating the use of your platinum card. Not only are these credit cards going to create creditworthiness increase on your credit report, but they also come with extremely high interest rates and expensive yearly fees that will increase you’re that and decrease your creditworthiness with a mortgage and other types of lenders.

When You Already Have Other Cards

If you already have department store credit cards or gas cards, use them minimally. Instead, use your platinum MasterCard and pay off the balance is right away to avoid accumulated interest fees. If it is necessary for you to use retail and gas store cards, work diligently on maintaining a very low balance and pay off the balances as quickly as possible. Carrying a balance on these cards from one month to another not only increases the amount of debt you owe but increases the amount of interest you pay for those purchases since interest is compounded on these cards.