Adjustable-Rate Mortgage (ARM): What It Is and Different Types

What Is An Adjustable-Rate Mortgage?

Whether you’re buying your first home or moving up to something bigger, an adjustable-rate mortgage (ARM) loan offers homeowners some financing flexibility. But what exactly is an ARM? And how might they fit into a homebuying scenario? We put together a simple overview of ARMs, including their types and average rates, along with a few examples of fixed and interest-only mortgages. So lets discuss the most important part of any loan and that is the qualifications which you will need to adhere to in order to be approved for the loan. A typical qualification for being approved for an ARM would be that you have had at least 5 years of credit history with no derogatory marks. You should also have a high enough debt-to-income ratio to qualify for a loan. If you are planning on using cash to pay off the house, then you’ll need at least $10,000 in liquid assets.

Adjustable Rate Mortgages (ARMs)

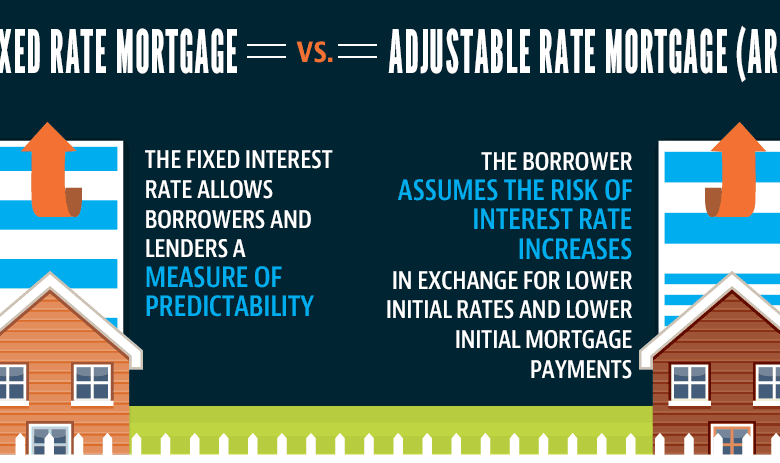

An ARM requires monthly payments that adjust based on changes in interest rates. Unlike conventional mortgages where the payment stays fixed throughout the term of the loan, ARMS require borrowers to make larger payments upfront than they did previously. However, if interest rates go down, the borrower will save money over time since their initial payment was lower. Conversely, higher interest rates mean the borrower ends up paying more per month. A couple reasons that people opt for ARMS include flexibility and tax advantages.

Flexibility

When you purchase an ARM, your lender gives you a set amount of financing for the home’s purchase price. Once you’ve paid off the full balance of the loan, your lender will renew your loan until its maturity date. At this point, you won’t have to worry about making any additional mortgage payments. Additionally, if interest rates drop significantly after you take out the loan, you may only end up paying more on principal instead of interest.

Tax Advantages

Another advantage of taking out an ARM is that you don’t pay taxes on the interest portion of the mortgage each year. Instead, you pay taxes only on the principle portion of your loan. The IRS considers the interest portion of a mortgage to be taxable income. As a result, many homeowners choose not to take out traditional mortgages, opting to get an ARM instead. Some states do treat certain types of ARMs as sales rather than loans. In these cases, you might be able to deduct some state property taxes from the sale of your home if you’re selling before the five-year mark. Generally speaking though, most states only allow you to deduct property taxes from the proceeds of a true sale, not from an ARM.

Current mortgage and refinance rates |

| Product | Interest rate | APR |

|---|---|---|

| 30-year fixed-rate | 6.449% | 6.563% |

| 20-year fixed-rate | 6.244% | 6.351% |

| 15-year fixed-rate | 5.572% | 5.784% |

| 10-year fixed-rate | 5.480% | 5.758% |

| 7-year ARM | 5.877% | 5.580% |

| 5-year ARM | 5.682% | 5.457% |

| 3-year ARM | 2.340% | 3.371% |

| 30-year fixed-rate FHA | 5.750% | 6.728% |

| 30-year fixed-rate VA | 5.825% | 6.222% |

ARM Loan Types

ARM loans usually fall into one of three types. These are explained below:

- A “Hybrid ARM” is one of the most common types of adjustable-rate mortgages (ARMs). After an initial fixed-rate period, the interest rate typically adjusts every 6 months or annually, depending on the lender.

- Interest-only ARM: Only the interest is paid during the first period. During the rest of the term, no principal payment is made, but regular monthly payments will be required during the entire term. Once the initial term expires, borrowers will start making payments on both their principle and interest.

- Payment-option ARM: Borrowers can select their own payment plan. Some common plans include paying both principle and interest, interest only, and an alternative minimum payment (AMM). They may also select a payment schedule such as every month, biweekly, semi-annually, or yearly.

Compare ARM Rates

As an initial matter, let us assume that your loan has five years remaining on it. In order to determine how much money you can borrow in the future, it would be helpful to know what your monthly payment will be. You can find out by dividing your total principal balance by 12 (the length of one year) and then multiplying by $1 per month. Thus, if your current percentage rate is 4% and your total principal amount is $200,000, you could calculate how much you could borrow in five years by multiplying $20,000 ($100,000 x.04 $4,000/month x 5 months – $24,000 $20,000).

5/1 vs 3/1 ARM Rates

In order to calculate the monthly payment amount on an ARM, we must first figure out how much principal remains on the loan after the teaser rate expires. We do this by dividing the total amount borrowed (principal and interest) by the number of months left before the next scheduled adjustment date. For example, if your 30 year loan had a $100K loan balance and you paid down $10K during the six month teaser period, then the following calculation shows what your monthly payments would be after the 6 months are complete, at that time the math would work out to a principal paid of ($100K)/(6 Months)(12 Payments Per Year)$1667.00 / 12 $134.44 per month. This is the same process you’d use for any other type of mortgage. The only difference with an ARM is that there’s no final balloon payment at the end of the term since the entire amount has already been repaid.