Best Balance Transfer and 0% Intro APR Credit Cards with No Balance Transfer Fee

How Do Credit Card Balance Transfers Work?

Companies are offering a 0% intro APR and no balance transfer fee and purchases for close to two years with some companies exceeding two years. The APR is used in reference to the annual interest rates applicable to credit cards, mortgages or loans. Concerning credit cards, the APR is crucial to making informed decisions on card selection. The interest rates range between 10%-30%. The APR will help you know how much a transaction will cost. The balance transfer rates during this period range from 3% to 5% of the amount of transfer or $5 whichever is higher. The cards have no annual fee. However, the issuer has no liability for unauthorized purchases.

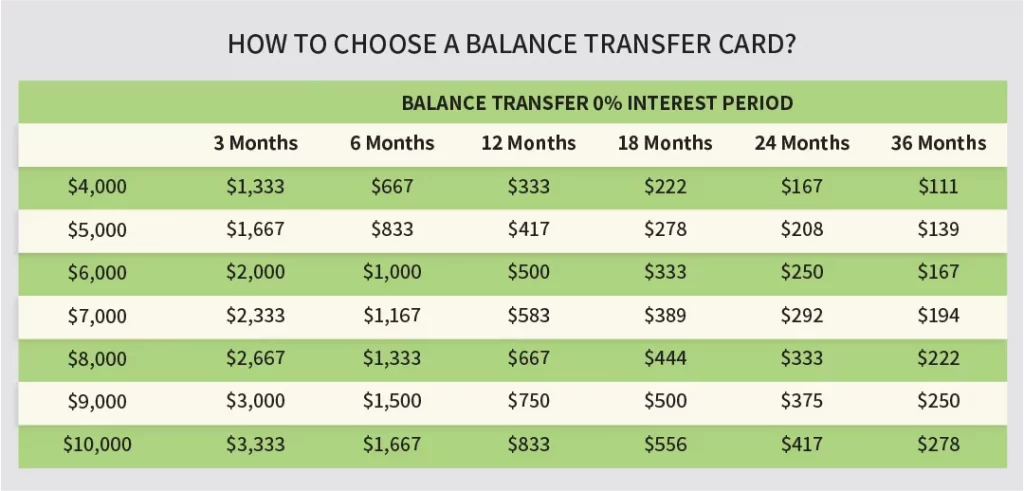

Choosing A Credit Card

The choice of a credit card should reduce the cost of debt and interest burden. Some credit cards offer 60 days no balance transfer fee. Notable is the fact that only a few companies will combine 0% APR with no balance transfer fee. Some cards will offer 15 months zero APR while others go as long as 33 months. The longer APR is, of course, preferable to anyone wishing to reduce cost. However, you need to carry out due diligence as some are just but promotions. The zero APR may not be applied to the period as advertised. Majority of us may overlook the long-term APR after the promotion.

Look For The Length Of Benefits

It is crucial that your credit cards still give maximum benefit after the promotion. The best way to ensure this is to make sure you have a clean credit history. With an excellent credit rating, you stand to benefit from the lowest APR after the promotional period. Also important in choosing a card with long-term service are companies that do not charge interest as long as the credit repayment gets made within the set period. Also, you will need to look at the ongoing APR and balance transfer fees of the company that you choose. The range is from 13.99% to 24.49%. A low APR is preferable because long-term high APR makes credit expensive.

Different Options for Different Situations

If you or your business is carrying a substantial balance on your credit cards, the 0% intro APR is crucial in reducing debt and interest problem. If you are looking to move from your current credit card, the key consideration is interest and debt. The length of the 0% APR offer differs among credit cards. For you, who are struggling with finances a longer bid will shield you from high penalties and interest. Late payment fee can go up to $35 as well as ruin your credit history raising it to almost 30%. You will also look into the reward system though this may not make a significant impact. If you are in business, you will be impressed by a firms credit cards. With the low APR, the company can reduce interest payments. Though they have a short-term low APR period, the variable APR is on the lesser end of the investment spectrum.

Qualifying For Minimum Rate

If you qualify for the minimum rate, the variable interest rate will benefit your business. Having learned that one can take advantage of low APR, let us see how you will save. The secret is in taking advantage of 0% APR and the best balance transfer. During the grace period, any purchases repaid by the due date do not attract any interest. However if the customer carries forward any balance, they pay interest on the outstanding balance. Instead of taking an initial high amount and repaying it over an extended period, you should transfer the card balance and take advantage of the 0% APR and no balance transfer fee. A one-time cost is more expensive than that paid for a longer time. However, the reality is that people are continually making new purchases. The card balance will steadily go up. Nonetheless, it is to your advantage that you enjoy the 0% APR and the best balance transfer fees available. You may consider taking advantage of them to attain financial stability for both you and your business.

List of Credit Cards with No Balance Transfer Fee

Here is a list of credit cards with no balance transfer fee which is comprised of the Citi Diamond Preferred Card, the Amex Everyday Credit Card, and the Capital One Quicksilver card.

Citi Diamond Preferred

The Citi Diamond Preferred Card has to offer is a great no initial offer, but has the best rates out of the other 2 cards. Furthermore, the Citi Diamond Preferred Card has a 0% intro APR for all balance transfers 21 months after the first balance transfer is initiated on the credit card. This card also offers 0% APR on all purchases for the first 12 months then eventually a variable APR rate kg 14.74% to 24.74% based on the individual’s credit score.

Amex Everyday Card

The Amex Everyday Card is a bit different and actually has an initial offer. The initial offer of the Amex Everyday Credit Card provided by American Express provides an opportunity to receive 10,000 Membership Rewards Points if an individual can spend $1000 in purchases within the first 3 months of having the card. Furthermore, the Amex Everyday Credit card offers 0% on both purchases and balance transfers for 15 months if used within 60 days of opening the account with the card. This is not as long as the Citi Diamond Preferred Card but it does come with an initial offer. One more great feature that the Amex Everyday Credit Card Offers is that in United States supermarkets cardholders can earn 2x the Membership Rewards Points up to $6,000 the 1x the amount spent afterward another great bonus for this card.

Capital One Quicksilver Card

The Capital One Quicksilver Card with an initial of giving cardholders the opportunity to earn a $150 bonus if they spend $500 within the first 3 months of having the card. Another cool bonus this card offers is the opportunity to earn 1.5% cash back on all purchases, which is a really cool feature that cardholders can earn thousands back. Lastly, the Capital One Quicksilver Card offers 0% on both purchases and balance transfers for up to 15 months, also making this a very competitive 0% balance transfer credit card on this list of credit cards with no balance transfer fee.

List of Credit Cards with 0% Intro APR

Here is a list of credit cards with 0% intro APR that is comprised of 3 credit cards known as the Capital One VentureOne Rewards Credit Card, Bank of America Travel Rewards Credit Card, and the Chase Freedom Unlimited Card. This list of credit cards with 0% intro APR all have different bonuses that they offer that different customers may be more inclined to apply for.

Capital One VentureOne Rewards

The Capital One VentureOne Rewards Credit Card that comes with an initial offer of 20,000 miles or $200 in travel when an individual spends $1,000 in the first 3 months if having this card making for a great card for travelers. Furthermore, this card also has an opportunity that allows cardholders to earn 1.25x miles to the amount spent on all purchases, again another bonus for frequent travelers. This card also offers 0% APR on all purchases for the first 12 months of having the card.

Bank of America Travel Rewards

The Bank of America Travel Rewards Credit Card has an initial offer that provides an opportunity to receive 25,000 bonus points equivalent to around $250 in travel if an individual spends $1,000 within the first 3 months of having the card. In addition to a great initial offer, the Bank of America Travel Rewards Credit Card offers 1.5x the amount spent on all purchases. The Bank of America Travel Rewards Credit Card also has 0% initial APR on purchases for the first 12 months of having the card.

Chase Freedom Unlimited

The Chase Freedom Unlimited Credit Card has an initial offer that provides cardholders with an opportunity to earn a $150 bonus after an individual spends $500 within the first 3 months. Another cool feature the Chase Freedom Unlimited Credit Card has is that it offers 1.5% cash back on every purchase. Furthermore, the Chase Freedom Unlimited Credit Card has a 0% initial APR on all purchases for 15 months making for another great card that offers 0% initial APR.

What to Look Out for When Transferring Balances on Credit Cards

There are a few things that individuals should know what to look out for when transferring balances on credit cards like the only way to save money by balance transferring, individuals can transfer other debts besides credit card debt, and how individuals cannot repeat transfer balances. The subject on what to look out for when transferring balances on credit cards is the only way to save money is by transferring a balance on a credit card that does not charge on balance transfers and also does not have a higher interest rate as the original holder of the debt balance that is being transferred to the individual can save money. Using balance transfers only benefits individuals in the long run if they are planning on paying a balance over a long period of time.

Transferring Debt

Next, knowing that individuals can transfer other debt balances besides credit card balances can be very beneficial for individuals who have other debts besides just credit card debt. To be more specific, companies may allow balances transfers on cars, furniture, and other big purchases by writing checks to those companies to pay off the debt adding to the balance of the credit card. Lastly, individuals must understand that they cannot simply repeat balance transfers continuously without reaping some negative side effects. Moreover, individuals who try to keep switch the same debt to other new 0% on balance transfer cards will soon find out that their credit score will lower and companies will be less inclined to approve loan or credit card applications.